This year numerous investors, influencers, bankers, etc. were talking about bitcoin, expressing their opinions about the most popular cryptocurrency in the world. Some of them were highly skeptical, saying bitcoin was a bubble that would inevitably burst at one point. On the other hand, others were optimistic about the future of bitcoin.

Let us see what opinions we heard during this year.

In September, Jamie Dimon, the CEO of JPMorgan Chase investment bank, said: “It is a fraud. It is worse than the tulip bubble. It will not end well.”

Ray Dalio is the founder of the hedge fund called Bridgewater Associates and during an interview in September he said: “Bitcoin is not an effective way to keep your assets because of its volatility, unlike gold. Bitcoin is a highly speculative market, a bubble.”

Peter Schiff was one of the people who predicted the big housing crisis in 2008. The CEO of Euro Pacific Capital expressed his opinion on bitcoin in August this year: “Obviously there is a lot of optimism around bitcoin and the cryptocurrencies and this is the general case when it comes to bubbles. The psychology of the bubbles nurtures this optimism and you are convinced it would function and the higher the price, the more convinced you become. It is not going to rise because it is going to function. It is rising because of the speculations.”

Warren Buffett is one of the most famous investors in the world and his opinion on bitcoin is not so positive. During a Q&A session in October 2017, Buffett said: “The people are excited because of the big movements of prices and Wall Street is adapting. You cannot value bitcoin because it is not an asset which creates value.”

In September, John Hathaway, the investor from Tocqueville Asset Management called the cryptocurrencies garbage: “Of course you can earn money with bubbles in any moment, but you have to go out. We should not forget that the market capitalization of the cryptocurrency market is 180 billion US dollars, it is too small when compared to gold.”

Tidjane Thiam is the CEO of Credit Suisse and he said: “From what we can see, the only reason to buy or sell bitcoin is to earn money, which by itself is the definition of speculation and bubble.”

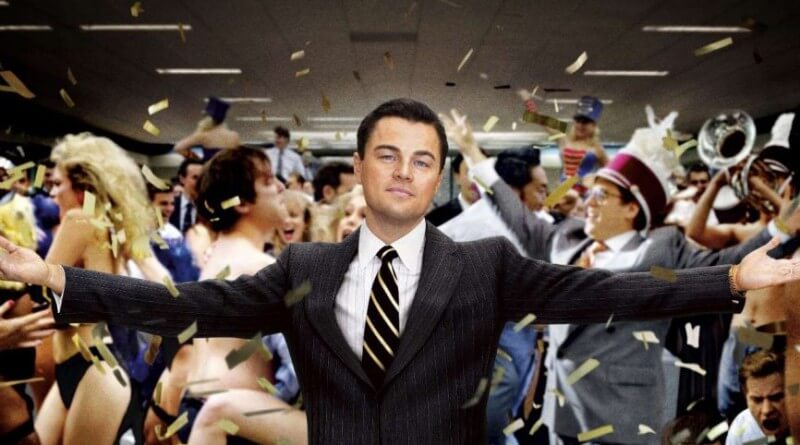

Jordan Belfort from Wall Street supports the stance of Jamie Dimon from JPMorgan Chase investment bank: “I am not saying you should or should not buy bitcoin, but personally, I would be very, very careful when it comes to investing a lot of money in something that could disappear very quickly.”

Carl Icahn, the founder of Icahn Enterprises said in December: “I should tell you frankly, I do not understand it, I just don’t understand it. I am not owning something I don’t understand.”

On the other hand, there are many optimists when it comes to bitcoin.

Mike Novogratz, a famous investor said: “This is going to be the biggest bubble in our lives. The prices will go far beyond what they should go to. You can earn a lot of money and we plan on earning it.”

Bill Miller, a famous hedge fund investors is optimistic: “I have a lot of confidence when I say the majority of the people who are criticizing bitcoin had not studied it well. In other words, they have a strong opinion about something they have not seen.”