A group of institutions of the European Union published a document in which they warned the potential investors in the cryptocurrency world about the risks that these financial instruments can bring along.

The document talks about the risks associated with the lack of regulations for the cryptographic ecosystem, the operational problems and the risks about the security of the investments in cryptocurrencies, especially the risks of hacker attacks and other cybernetic attacks.

The laws of the European Union do not guarantee protection for the investors in cases when the cryptocurrency exchanges are attacked by hackers or suffer from internal functioning problems. In these cases, the funds deposited would be lost and there would be no way to make an official claim to the authorities.

The document was created by the European Supervisory Authorities (ESAs), comprised of the European Banking Authority (EBA), the European Securities and Markets Authority (ESMA) and the European Insurance and Occupational Pensions Authority (EIOPA). The warning is based on the article 9 of the three founding regulations of the ESAs.

The European Supervisory Authorities said the following: “The digital currencies that are currently available are a digital representation of value that is not emitted nor guaranteed by a central bank or public authority and does not have a legal status of a currency of money. These assets are highly risky, generally not backed up by a tangible asset and they are not regulated by the legislation of the European Union, and therefore do not offer any legal protection to the consumers.”

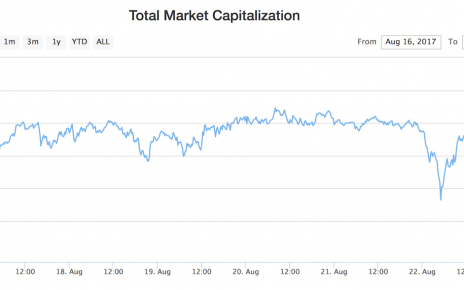

The three institutions expressed their concern about the fact that the number of people investing in this type of virtual currencies is increasing and these people have high expectations for their investments, without being conscious of the high risk of losing their invested money. In accordance with the authorities, the cryptocurrencies are extremely risky due to their speculative character and the volatility of their prices.

The document also say that, despite the regulations for the prevention of money laundering operations in the European union that will enter into force this year and affect the wallet providers and cryptocurrency exchanges, the regulation is not sufficiently strict yet, which means the risk is still significant.

Even so, the ESAs understand that certain investors could decide to take all these risks, and that is why the authorities urge them to completely understand the characteristics of the cryptocurrencies: “They should make sure to be cautious when it comes to the security measures and the hardware and software used to buy, transfer and store their digital currencies.”

Recently, the ESMA published a statement in which it informed the public about the plan of the authorities to follow the cryptocurrencies and the ICOs during this year. This plan will be part of the joint agenda of the ESAs. The objective is to boost a regulatory agenda that would align the goals of the ESMA with the goals of other entities involved in the regulation of the cryptocurrencies. The newest document published by the ESAs confirms this stance of the ESMA.